By Edouard Demeire, Strategic Pharma Marketing expert and trainer of CELforPharma's 2-day The Pharma Brand Planning Course.

Historically, pharma brand plans were written to plan for the development and cross-functional alignment of clinical data communication, both at a strategic and tactical level. While that is still the case, an additional objective has become to develop the cross-functional team’s patient and customer centricity. To enable an agile response to stakeholders it is critical to develop so-called insights.

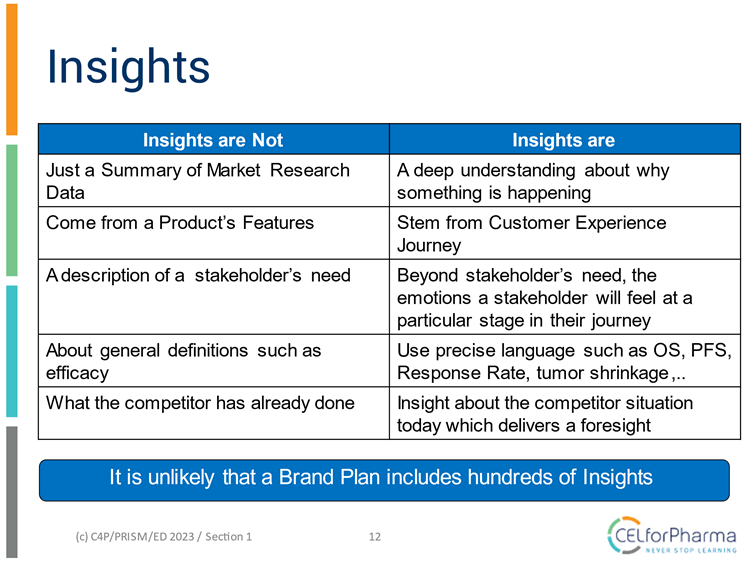

But what are "insights" and how does an insight differ from key data obtained from traditional market research?

The checklist below shows criteria which allow you to evaluate how insightful your brand plan is.

Below you can find examples of the application of each of these criteria:

Two brands were competing in a specific type of solid tumour. One had significant overall survival data (OS) and the other showed superior Response Rate (RR).

While one would expect that the brand showing OS data would dominate that segment, it didn’t. The rationale for this, from an oncologist perspective, was that the higher response rate enabled them to show more often tumour shrinkage images visually to their patients early in the therapy.

Additionally, they could justify the effect of the chosen therapy on the individual patient to payers already before the therapy had been completed.

The early, visual proof of effectiveness is the insight rather than the RR data.

There was a case of a chronic autoimmune disease, where prescribers initially started patients on therapy using subcut injectable products then switching them to oral therapies as the disease progressed.

One company developed a highly effective drug, delivered twice yearly as an infusion. A weakness revealed in a traditional brand plan would have been ‘infusional therapy’.

However, the real insight was that treating physicians were hesitant to switch their patients back from oral to a twice a year infusional therapy under the assumption that most people don’t like infusions (needle phobia, spending time in the infusion seat,…). Whereas in fact an important subset of patients felt much better with the therapy and didn’t mind getting rid of the daily hassle of taking a pill, reminding them every day of their disease.

Often, pharma execs are frustrated with the medical community’s slow adoption of what they believe is an innovative, clinically proven superior therapy.

Key to understanding pain-points in the adoption journey is the development of insights about how stakeholders feel emotionally.

Do HCPs have too many patients, so they don’t feel they should invest time in exploring the new therapy for one patient but allocate time to all other patients?

Or are HCPs afraid of adverse events and fear to be confronted with unexpected challenges, being seen by patients as prescribing less proven therapies?

Or do they simply feel they should not adopt higher priced therapies in order not to project the image of being a spendthrift, contributing to exploding health care costs?

...

The understanding of how stakeholders feel emotionally will be crucial to rapidly unlocking the pain-points and fast growth of a brand.

When developing a brand plan, the brand team often faces the trade-off between simplicity (with the objective of aligning the organisation with a short and simple plan) versus specificity (ensuring the organisation precisely understands what the issue is).

For example, a brand plan for a product with patients suffering several comorbidities relating to metabolic syndrome described efficacy as cardiovascular risk reduction. This corresponds to what scientific KOLs and access related stakeholders will define as key endpoints.

However, these patients (and HCPs managing them on a daily basis) also seek effective solutions that allow them to engage in activities of daily living. So, for for each comorbidity (CHF, T2D, weight and potentially even depression,…), patient defined measures of efficacy would be different, based on the symptoms.

In a multi-stakeholder environment, it is increasingly important to differentiate each of the outcomes relating to each stakeholder and personalise the solutions across the spectrum of patients with multiple combinations of the comorbidities.

Brand plans often include comparisons of competitors' published clinical outcomes, ongoing medical activities, commercial and access related tactics. While this is an important exercise that allows competitive benchmarking, it often results in ‘catch-up’ situations.

Brand plans should also perform ‘one-up’ analysis of key competition, looking at their corporate Goals (often shared in financial analyst presentations), Assumptions about factors driving a particular market, an analysis of Current Competitor Capabilities and, finally the Competitor’s Current Strategy.

Overlaying the first three on the current strategy can help identify future strategies and tactics, at a corporate or at least portfolio level. Useful exercises can include the development of a competitor SWOT and/or competitive simulations.