From the Across Health MATUROMETER 2023

Digital transformation takes time and is risky: only 10% of transformation projects fully succeed (ZS Associates 2022). So, how is pharma faring in this space? In its annual (15th!) Maturometer survey, Across Health once again takes the pulse of pharma’s efforts and ambitions in the digital & omnichannel space.

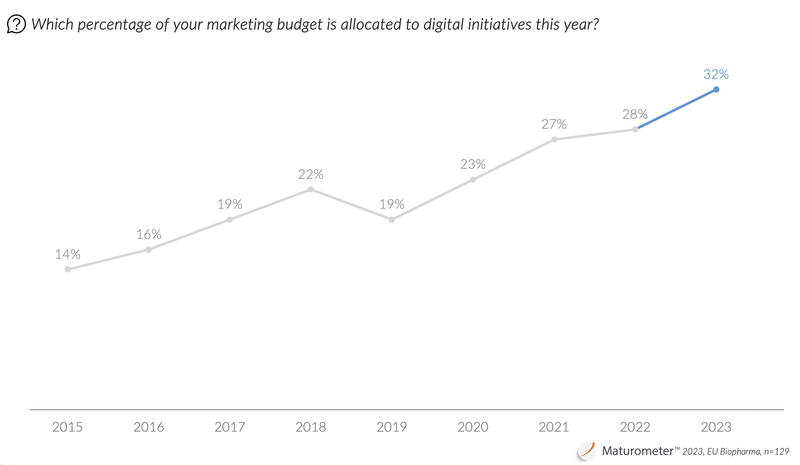

Pharma digital budgets continue to climb – but still lag behind B2B

Despite digital’s share of budget increasing to an all-time high of almost a third, this figure remains notably lower than the approximately 50% that B2B industries allocate to digital.

So while the year-on-year increase points to a continued belief in omnichannel investment, the discrepancy vis-à-vis the B2B industry suggests that the budget allocated to digital efforts might not be sufficient to achieve the desired customer impact.

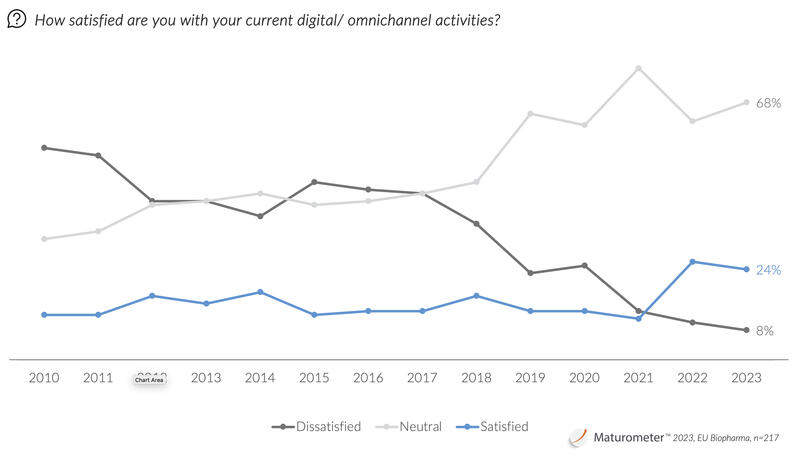

Satisfaction levels among pharma staff do not follow increased budgets

After a strong increase in 2022… and despite the strong budget increase shown above… pharma satisfaction appears to be plateauing already – only 1 in 4 is satisfied. The segment of dissatisfied respondents has been declining since 2016 to an almost negligible 8% in 2023, but 2 out of 3 respondents remain unconvinced either way.

And assuming the Maturometer sample is slightly biased towards omnichannel-savvy/interested respondents, the ‘neutrals’ will likely be even more prominent in the total universe. Are these the “hopefuls”, who believe their new digital efforts may pay off one day…but just not yet? Did they fail to define clear KPIs upfront to assess the business impact of their increased spend? Did they spend it on low-impact channels? Did the strategy execution create issues? … Or maybe it’s a bit of all of the above?

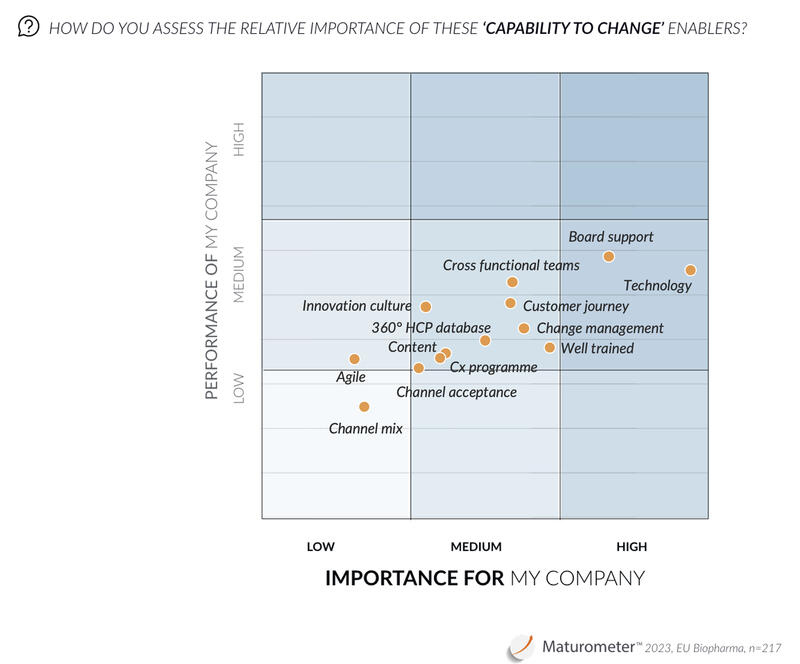

Is ‘Capability to change’ being hindered by selective (over)investment in some enablers over others?

Simply increasing digital budgets is no guarantee for business impact. Indeed, many other factors can jeopardise success in the omnichannel space. This chart confirms that biopharma tends to focus on certain capabilities – although none of them reaches the high importance-high performance box.

At the other side of the continuum, the low combined scores for items like channel mix (low-low) and channel acceptance (low-medium) draw the attention – perhaps they help explain the lowish satisfaction levels, despite higher budgets?

Where from here?

Looking at the next 2 years, there is a clear ambition to improve the customer journey across multiple touchpoints and move away from a product-centric to a customer-centric approach. This should result in a better customer experience. It should be noted, however, that this top 3 has been fairly consistent since 2019.

In summary, pharma is continuing its journey towards customer-centric omnichannel engagement; the pace of change has arguably dropped since the pandemic, but digital transformation remains high on the agenda. And indeed, pharma has to continue this effort, as HCPs – and other pharma stakeholders, like patients & payers – are increasingly expecting pharma to serve them “anytime anywhere”. We are in the midset of an exciting new era in life sciences. The time to act is now!

The full report can be found here.