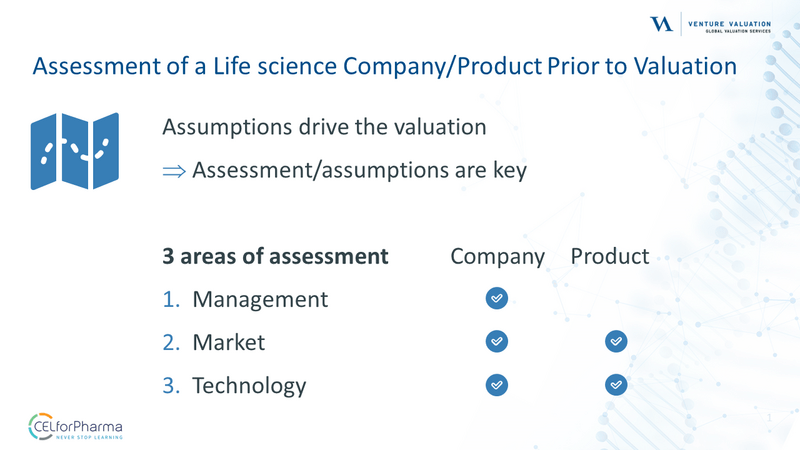

Valuations in pharma and biotech are driven by assumptions that vary based on the unique risk profile of the company or product. CELforPharma faculty member Dr Patrik Frei, from Pharma-Biotech Product & Company Valuation, has made a handy checklist that helps you identify critical factors and provides a framework for assessing aspects that could influence the valuation.

The checklist focuses on three essential areas that determine the value of a life sciences company or product:

1. 👔 Management

A company's leadership plays a pivotal role in its success. Assessing the quality of management involves evaluating:

Skills Completeness: Are the right competencies in place for effective decision-making?

Track Record: Does the management team have a history of delivering results?

Motivation and Incentives: Are incentives aligned with long-term value creation?

Emotional Intelligence and Social Competence: Can leaders inspire confidence among stakeholders?

2. 🗺️ Market Environment

Understanding the market environment is crucial for identifying growth opportunities and anticipating challenges. The checklist includes:

Market Potential: What is the current and future demand for the product or service?

Competitive Landscape: Who are the key competitors, and what strategies are they employing?

Regulatory Dependencies: Are there political or legal factors that could impact valuation?

Industry Structure: How do competitors, supplier and customer dependencies shape the company’s position?

3. 🔬 Science & Technology

In a sector driven by innovation, the strength of a company’s science and technology underpins its value. Key factors include:

Intellectual Property (IP): Is the IP portfolio robust and defensible?

Unique Selling Proposition: What differentiates the product in the market?

Alliances and Partnerships: Are collaborations helping accelerate development?

Time to Market: Can the company bring products to market efficiently?