By David Scott, expert-trainer of The Pharmaceutical Out-licensing Course

In pharmaceutical licensing, it is crucial to understand the concept of a royalty stack. It refers to the layers of royalties and fees that accumulate when multiple parties are involved in the development, manufacturing, and commercialisation of a pharmaceutical product. Failure to factor in the cost impact of third party inputs can have a huge impact on the viability of projects destined for out-license.

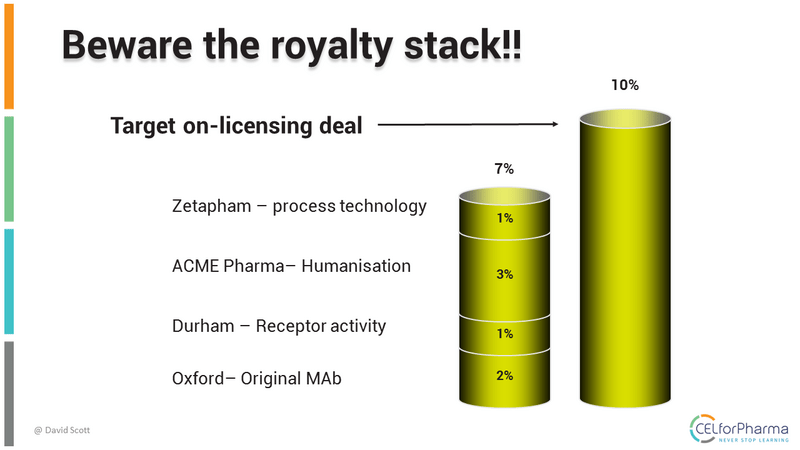

The below image shows an example where several royalties are applicable on a drug, and the likely revenue stream from out-licensing:

In this instance, the developing company in-licenses a murine antibody from a university for a modest royalty, but then finds this binds to a receptor whose activity has been patented by another institution, to whom it has to pay a royalty to avoid infringing their patent. The company then has to pay a subcontractor to humanise the antibody (such work often requires a significant royalty fee) and finally has to pay Zetapharm to have access to their proprietary purification technology. Although each payment is relatively small, the stack of royalties adds up to 7% which might well make the project unattractive if the target for out-licensing the finished product is only 10%.

Unraveling the Layers

This problem arising from a significant royalty stack can be resolved by substituting royalty payments to third parties with payments of four different types:

Share of Net Income:

This model involves giving licensors a portion of the net income generated from sales of the licensed product. While straightforward in principle, it can become complex in practice, especially when multiple licensors, licensees, and other partners are involved. Clarity in defining how net income is calculated and distributed is crucial to avoid disputes and ensure equitable compensation.

Licensing Fee:

A fixed annual sum payable to the licensor if sales exceed a certain threshold level. This provides a guaranteed income stream for licensors (albeit usually at a lower rate than would apply to a royalty stream) which can be attractive to academic institutions who seek certainty for future planning purposes.

Royalty on Units Sold:

This involves receiving a percentage of sales revenue for each unit of the licensed product sold, which places a more consistent value for the licensor’s input where this might be incorporated into products bearing significantly different sales prices and hence revenues.

Joint Ventures:

While seemingly straightforward, complications can arise when different royalty rates apply to different sales channels or geographic regions. Rather than seek complex contractual licensing arrangements another option is to manage the development and revenue streams arising from the programme via a Joint Venture; all the companies providing inputs to the final product can then receive an appropriate equity share in the JV and then receive dividend payments in lieu of any royalty streams.