By Dr Patrik Frei, expert-trainer of Pharma-Biotech Product & Company Valuation

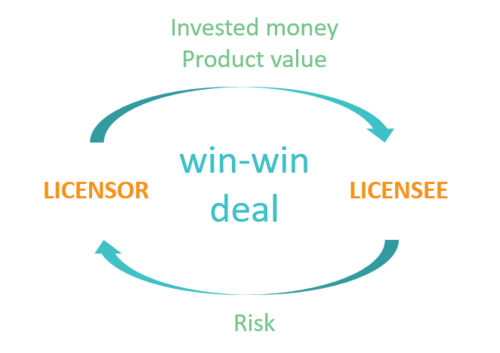

The objective of any deal should be to create a win-win deal

To achieve it, business development executives on both sides of a licensing deal must ensure that they strive for a fair deal structure, which means that both sides of the licensing deal have to make sure that:

The licensor receives payments reflecting the invested money as well as the current product value

The licensee is compensated for taking the risk associated with the future product development

The selected valuation model is transparent and the rationale behind the used assumptions is clear and based on solid data

A successful deal structure is based on the following consecutive steps:

Determine the product value

Determine the handover time point

Determine milestones and royalties

Negotiate until you have a draft of an initial term sheet

What is the most important step in the deal-making process?

Even though it is paramount to get each of the 4 steps in the deal-making process right, there is still one that is the key to a successful win-win deal, namely: the product value. Without a realistic product value there is a high risk that the value gap between the licensor and the licensee will be too large to reach a consensus.

The risk-adjusted Net Present Value (rNPV) valuation method is highly suitable and widely accepted for calculating the product value. The model is clear, transparent and allows one to consider different deal structures, while understanding how the value is split between the licensor and the licensee.