Incorporating the right pre- and post-launch KPIs in the local launch plan is essential for a successful brand launch. In the below article, Jo Lopez, CELforPharma faculty member of the Effectively Leading Country Launches in Pharma course, highlights the different types of metrics, the critical role of KPIs, and best practices for selecting those indicators that will ensure strategic alignment and operational success.

Not all metrics are alike

Including metrics in your brand launch plan is crucial for tracking the progress and effectiveness of various launch strategies and tactical decisions. In the context of pharmaceutical launches, metrics can be categorised into three different types:

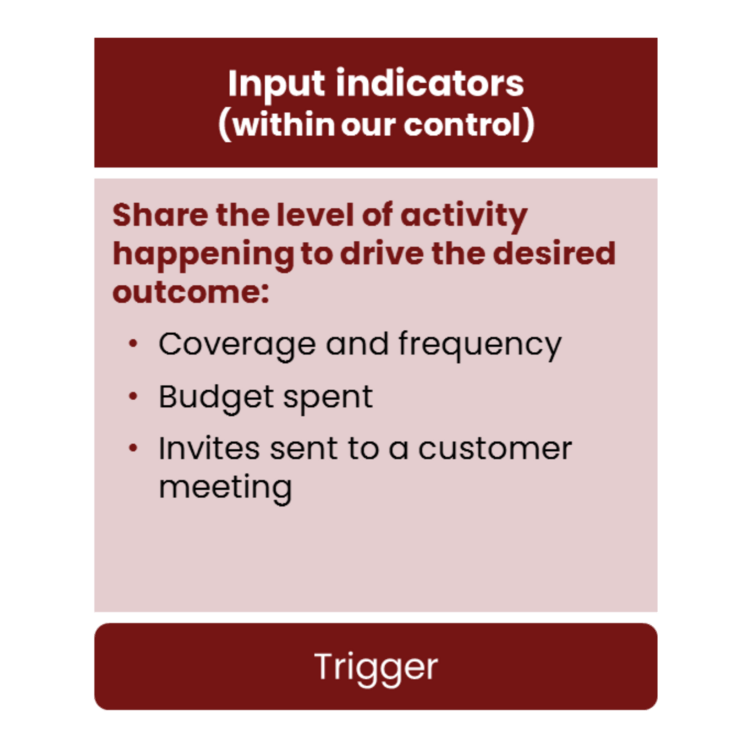

1. Input Metrics:

These metrics track the activities necessary to achieve desired outcomes, such as the frequency and coverage of marketing activities towards HCPs, budget expenditures, etc.

These are within the control of the launch team and are essential for driving initial engagement.

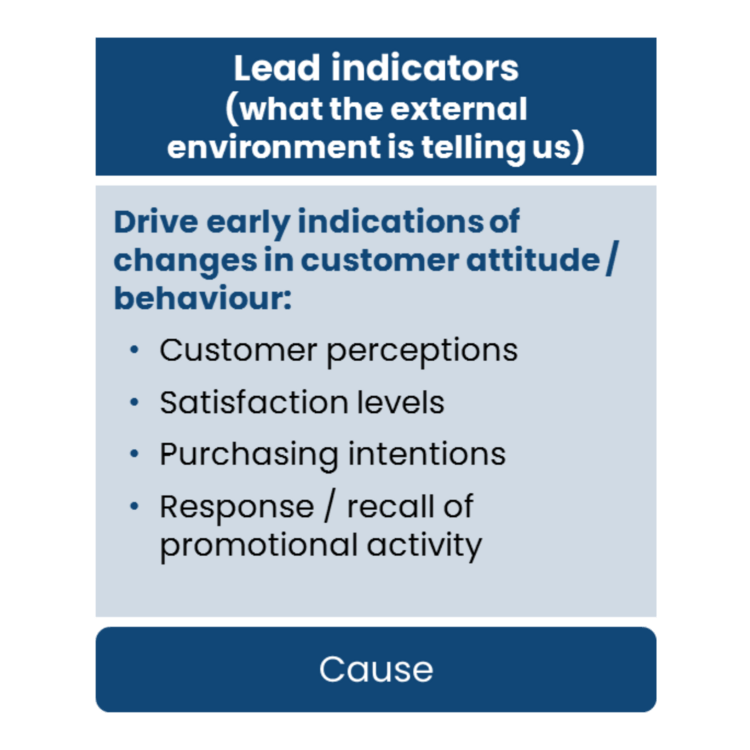

2. Lead Metrics:

These metrics provide early indications of changes in HCP attitudes or behaviours. Examples include perceptions, satisfaction levels, prescription intentions, and responses to promotional activities.

Lead metrics offer insights into how the external environment is reacting to the launch efforts and can guide mid-course adjustments.

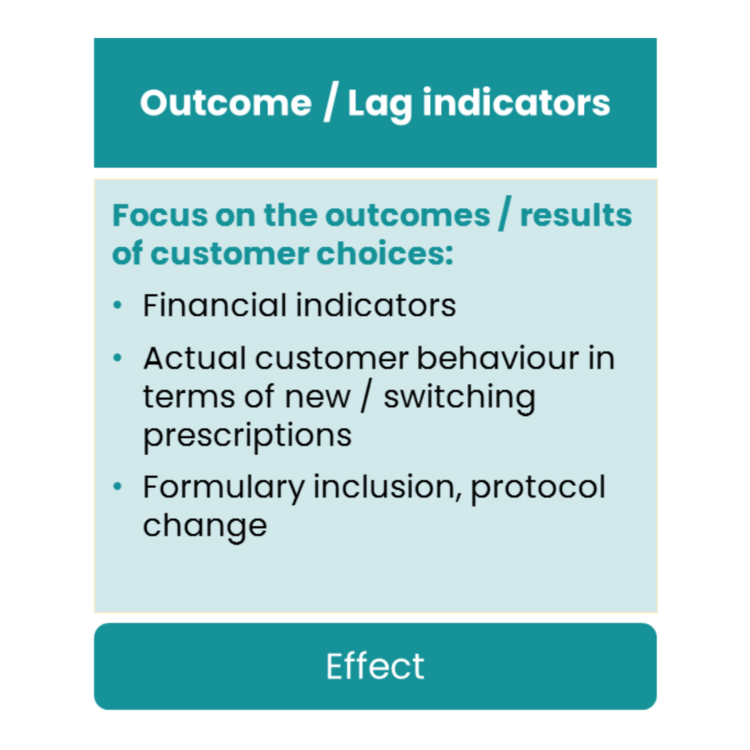

3. Lag (Output) Metrics:

These metrics focus on the outcomes resulting from customer decisions. They include financial indicators, actual customer behaviours such as new or switching prescriptions, and changes in formulary inclusion protocols.

Lag metrics help assess the overall impact of the launch activities.

Metrics vs KPIs…?

KPIs are metrics that are pivotal for the success of a pharmaceutical product launch. They are the critical metrics that help align the launch activities with the strategic objectives of the company. Selecting the right KPIs requires a deep understanding of what is crucial for the launch and ensuring that these indicators are directly linked to the identified strategic goals.

Taking the pulse on your KPIs

To ensure the effectiveness of the set of KPIs you have selected, use the below short checklist:

- Strategic Alignment: Are the selected KPIs aligned with the strategic imperatives and objectives of the launch?

- Compliance: Are they consistent with company compliance policies and local industry codes of practice?

- Measurability: Are they measurable in a consistent, practical, and cost-effective manner, even over time?

- Relevance for Decision-Making: Are they relevant for making course-correction decisions to optimise performance during the launch?

- Balanced Measures: Does the set of selected KPIs reflect a balance that consider customers, market conditions, and competition?

- Time-Oriented Targets: Are the KPIs set with specific, time-bound, and quantified targets to track progress effectively?

Being SMART about objectives

Effective measurement begins with setting the right objectives. Using the S.M.A.R.T. framework (Specific, Measurable, Realistic, and Time-based) is key. For instance, an objective might be to increase the market share in key accounts from X% to Y% by the end of Q1 20XX. If an objective cannot be measured, it should be reconsidered.